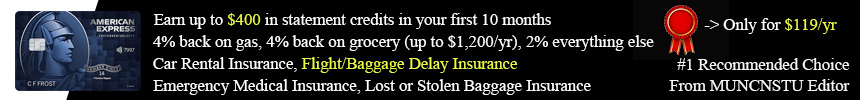

很多朋友不清楚信用卡带的一些保险有何作用,如何触发理赔。小编在此以涵盖特别全面的AmEx Platinum Card为例简要解读。首先说明,要理赔这些保险,涉及商品服务交易的,需要提供商品/服务收据(大宗高价值的务必保存好)以及当期信用卡账单(设置电子账单随时调阅),同时要求信用卡账户active(销卡销户前请三思/消费时想好用哪张)。至于哪些卡带哪几种保险,请移步“信用卡”版。以下英文材料摘自AmEx页面。

Emergency Medical Insurance (Out of province/country)

Provides coverage for eligible emergency medical expenses incurred while traveling outside your Canadian province or territory of residence, for the first 15 consecutive days of each trip, up to a maximum of $5,000,000 per insured person, for all insured persons under the age of 65.

解读:一般称此为“省外医疗保险”,用于理赔在居住地之外发生的紧急医疗援助。此项保险,有年龄、时效限制(只保出行的前n天)。一般要求持有居住省份医疗卡。主页君一度对此保险抱有某种程度的偏见,直到听说了一起留学生理赔的案例,才意识到此项保障对留学生群体的意义。一般来说,加拿大留学生能够申请到所在居住地的免费政府医保。但如果你出行到其他省份,需要医疗服务时,此项保险就能发挥作用,为你省下一笔不菲的医疗账单。(西方国家看病贵……)关键一点在于,不像后面要说的“航班延误保险”,“省外医疗保险”并不要求你用卡做任何消费,只要有这样一张卡待在你的抽屉或者钱包里,就好了。

Car Rental Theft Damage Insurance

Save money when travelling with complimentary Car Rental Theft and Damage Insurance. Where allowed by law, you will be automatically covered for damage or theft of your rental car with an MSRP of up to $85,000. To take advantage of this protection, simply decline the Loss Damage Waiver (LDW) or similar option offered by the car rental company, and fully charge your rental to your Platinum Card. There’s no additional charge for this coverage, and you save yourself the daily insurance fee (usually $16 to $23 per day) charged by the car rental company.

解读:租车险。一般来说,要用带租车险的卡全额支付租车费用,要拒绝租车公司提供的保险服务,才会理赔;对所租车辆的市场价格设有上限。如果在租车行单买此项保险,每天收费一般要$20左右。这也是为什么小编建议大家要持一张带租车险的卡,省钱效果可观。

这里可能有朋友要说Primary/Secondary的问题。这部分具体含义就不展开说了,有兴趣可以自行做功课或者和主页君单独交流。严格上说,加拿大信用卡的租车险多为Secondary,重大事故的理赔原则上是优先走个人车保,并且可能进入个人的保险记录。但从实践上来说,小刮小蹭一类的轻微损失最后免了你自己的赔付这种没有记录的,所以大可以放心。

理赔指南

还是那句话,在damage发生的第一时间给信用卡公司打电话set up case,越快越好,并拿到case file number。

大多数情况下,信用卡上的租车险是可以cover大部分拖车费用的。所以在租车时不必额外购买road assistance。

在预订和最后还车支付时请使用同一张带租车保险的信用卡。

需要提供的材料:租车当月statement(或者已经post的信用卡交易截图),租车合同agreement,租车行提供的damage report/repair cost,损坏车辆照片(可以全程请租车行提供)

Flight Delay Insurance

Charge your airline ticket to your Platinum Card and receive up to $1,000 coverage (aggregate maximum with Baggage Delay Insurance) for hotel, motel, restaurant expenses and other sundry items.

解读:航班延误险。用带此险的信用卡全款购买机票(对于Scotiabank/CIBC,全款>=75%),如果航班发生延误/超售/取消等情况,对行程影响超过一个特定时长(一般是四小时,少数如BMO是六小时),可以获得过渡期间食宿以及必要开销(只要能提供合理解释)的理赔。有理赔上限。一般是由航司开具延误证明,保留好食宿及其他合理消费的收据小票(使用其他信用卡或是现金支付均可),向信用卡公司提出理赔。

我们之前已经有一篇文章讲解了《再论航班延误险之必要性》

理赔指南

当航班延误超过四小时,或者合理推断将要超过四小时时,请第一时间致电信用卡公司set up a case,获得case number

贴士:对于AmEx——让客服转到insurance claim

比较容易claim的项目(收据有明确标明的):租车、酒店、吃饭。这些消费不必用购票同一张卡。

需要提供的材料,越详尽越好:信用卡公司提供的claim form,购票、消费的receipt,航司开具的延误证明(有时可以索取Military Excuse),相关航班登机牌,买机票当月statement(或者直接在online service截图购票交易记录)

递交材料:邮寄到指定地址,或者扫描为电子版发到指定email

关于积分票

Aeroplan积分票——用CIBC Aerogold Visa Infinite/TD Aeroplan Visa Infinite或这两个系列中更高级的Visa Infinite Privilege支付税费,则可以享受航班延误保障。其他信用卡支付税费均不保障。

Westjet Dollar兑换的机票——用RBC Westjet World Elite MasterCard支付余款可以享受航班延误保障。

AmEx Fixed Points Travel Program兑换的机票——用带延误险的AmEx卡片支付余款税费可以享受保障。

AmEx Aeroplan/Air Miles联名卡—可以保障使用卡片支付税费的同项目里程票

五大行自家积分项目(如Scotia Rewards、BMO Rewards)兑换的机票——使用带有延误险的对应Program卡片支付余款税费可以享受保险,请自行查阅确认。因为这些航司的“兑换”操作实际是先付全款,然后兑换的积分被作为credit返到账上。对于Scotiabank/CIBC,全款>=75%。

Baggage Delay Insurance

Book a flight with your Platinum Card and receive up to $1,000 coverage (aggregate maximum with Flight Delay Insurance) for all immediate daily reasonable and necessary emergency purchases, made within four days, for essential clothing and sundry items when your baggage on your outbound trip is delayed by six or more hours.

解读:行李延误险。一般要求用卡全款支付航班票价。(少数卡片,如Scotiabank买菜卡,只要用卡支付了75%票款即可)注意,outbound=仅限离开居住地(以信用卡账单地址为准)的航班。延误超过n小时,理赔行李到达前的衣物和必备用品采购。有的信用卡将此部分也并入到“航班延误”或“航班权益”的范畴,没有单独列出。一般是由航司开具延误证明,保留好合理消费的收据小票,向信用卡公司提出理赔。

理赔指南

比较容易claim的项目:衣物、个人日用品。注意,电子产品不赔,不要想太多。

需要提供的材料:买机票当月statement,购票成功的航司确认邮件,航班登机牌,航司开具的行李延误证明(拿到手时请拍照留档因为之后可能会被收走),标明了送达时间的行李收据,消费收据小票

Lost or Stolen Baggage Insurance

When you fully charge your airline tickets to your Platinum Card you can receive up to $1,000 coverage for loss or damage to your luggage or personal effects while in transit.

解读:行李失窃险。用卡全款支付航班票价,行李丢失、失窃,可以获得赔偿。有的信用卡将此部分也并入到“航班延误”或“航班权益”的范畴,没有单独列出。一般来说,失窃的理赔需要报警并由警方开具证明。

Hotel/Motel Burglary Insurance

Charge your Hotel/Motel arrangements to your Platinum Card and receive automatic coverage of up to $1000 against the loss of most personal items if your hotel/ motel is burglarized.

解读:住店失窃险。用卡全款支付房费,如果住店期间发生客房失窃,需要报警并由警方开具证明。

$500,000 Travel Accident Insurance

Up to $500,000 of Accidental Death and Dismemberment Insurance covers you, your spouse and dependent children under the age of 23 when any of you travel on a common carrier (plane, train, bus or ship) and charge your tickets to your Platinum Card. Supplementary Cardmembers, their spouses and dependent children under age 23 are also covered.

解读:旅行意外险。用卡全款支付公共交通票价,因事故导致持卡人、配偶、未满23岁子女伤残身故,可以理赔。

Trip Cancellation & Trip Interruption

Trip cancellation

When you fully charge your travel arrangements to your Platinum Card this coverage provides for the reimbursement of the non-refundable pre-paid travel arrangements, up to $1,500 per insured person to a maximum coverage up to $3,000 for all insured persons combined when you cancel a trip for a covered reason.

解读:旅行取消险。用卡支付了不可退款的旅行支出,在旅行开始前,由于受保障的原因不得不取消旅行,可以理赔。需提供证明。有理赔上限。

受保障的原因这里限于篇幅不一一展开,有兴趣可以看前面的图。概括起来说——

- 医疗方面,当事人(或配偶、直系亲属)身故重疾;其他被医生认为不应进行旅行的情况

- 非医疗方面,因不可抗力产生的客观因素。不包括商业上的因素。

需要提供的材料(部分):购票信用卡statement,购票成功的收据证明,退票成功的收据证明(证明你退票了,但由于是penalty/partial refund/non-refundable产生了损失)

Trip Interruption

When you fully charge your travel arrangements to your Platinum Card this coverage provides for the non-refundable unused portion of your prepaid travel arrangements, as well as transportation up to $1,500 per trip per insured person up to a maximum of $6,000 for all insured persons combined should your trip be interrupted or delayed for a covered reason.

解读:旅行中断险。用卡支付了不可退款的旅行支出,在旅行开始后,由于受保障的原因不得不中止旅行,返回出发地,可以理赔旅行未完成的部分的开支。需提供证明。有理赔上限。

Purchase Protection Plan

Automatically, without registration, insures your eligible purchases against accidental physical damage and theft when you use your Platinum Card.

解读:购物保障。大部分信用卡都带有此保险。一小部分卡片不带,典型的是TD/Scotiabank学生卡、入门卡。用卡支付商品货款,一定时间内(一般是90天,少数如Capital One的卡提供120天)商品如果发生意外物理损坏或者失窃,可以理赔损失。一般是理赔维修费用,如果不能维修,则理赔商品价格。有理赔上限。特殊商品,如汽车不在此保障范围。损坏需要由厂商或其指定服务商开具维修报价或鉴定书;失窃需要报警并由警方开具证明。

Buyer’s Assurance Protection Plan

This plan automatically doubles the manufacturer’s original warranty up to one additional year when you charge the full price on eligible purchases to your Platinum Card. This applies to products purchased with the Card anywhere in the world, provided the manufacturer’s warranty is valid in Canada and the U.S. and does not exceed five years. Jewelry, motorized vehicles, and their parts are excluded in this coverage. You will need approval before any repairs will be covered. Replacement and repair costs are limited to $10,000 per eligible item up to a maximum of $25,000 per Cardmember per policy year for all occurrences combined.

解读:延保,也叫Extended warranty。用卡支付商品全款,商品保修延长一倍,最多延长一年。少数卡片,如BMO Cashback WEMC最多能延长两年。需要理赔时,一般是由厂家出具维修报价,赔付维修费用。

注意,不同信用卡有各自的Exclusion,比如Rogers WEMC的一年延保不cover手机。建议大家自行查看手头的小册子。

我们之前有文章讲解过小额理赔的操作《一次AE运通购物保险小额理赔经历》

理赔指南

需要提供的材料:购物当月statement,购物(电子)收据,厂商维修报价单

以下是小编个人对信用卡自带保险实用程度的评价,从上到下,由高到低。

- 行李丢失失窃★★★★★

- 行李延误★★★★★

- 航班延误★★★★★

- 租车险★★★★★

- 省外医疗★★★★☆

- 购物险★★★★☆

- 延保★★★★☆

- 旅行意外★★★☆☆

- 住店失窃★★★☆☆

- 旅行取消★★☆☆☆

- 旅行中断★★☆☆☆

首次发布:2017-3-1

最后审阅:2019-11-7

原创文章,作者:MUNCNSTU,未经许可禁止转载。获得转载许可后,请注明出处:https://muncnstu.com/sharing/insight-into-credit-card-insurance/