来自读者投稿

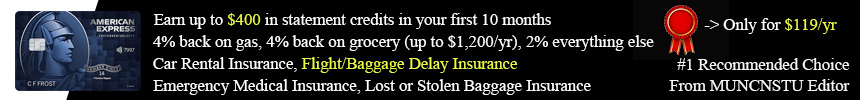

很早就听说从国内的工行汇款到加拿大工行非常方便快捷,并且从手机app上操作汇款可以免去国内那头的手续费,工行加拿大这头收$15 CAD。(听说中行加拿大只要$10 CAD,但自己在国内没有中行户头,所以就算了)之前自己也做了一些功课,了解到两个基本事实:1.账户月服务费$4,但只要存够$1000即可免去;2.用Pre-authorized Debit方式转钱到其他银行免费。(从他行发起;从工行发起有$1费用)【其他收费】基于实际需求,最近终于决定去位于Markham Pacific Mall太古广场的分行去开一个户头。

First thing first. 进行“工行转工行”操作,国内方面要做不少事前准备。以我本人为例,自己的国内工行户头很早的时候开的并且很少使用,上一次回国为了把这些手续办妥,大概得去了两三次分行,包括:重新认证身份、更新U盾、开通国际汇款权限、提高交易限额。

开户建议提前电话预约,Walk-in并不一定都能当场给你开。需要的材料如下。地址证明我找了一张AmEx账单,打印了带有地址的第一页出来。我那天去的时候还带了一张自己给自己写的$1,000支票(没有个人支票的话可以去Branch开Bank Draft),准备一开了户就存。

完成开户后会当场拿到Debit Card(银联、Interac、The Exchange三个标)和实体电子口令。这个账户下有三个币种:人民币、加币、美元,汇进来是哪个币种就进入哪个币种。并且,客户经理会当场引导你修改设置卡片密码和网上银行密码,还是很周到的,并且也帮我存好了$1,000支票。收汇款的信息也是当场提供的,其中“工行转工行”和“他行转工行”略有不同。拿着这些信息就可以去国内工行的APP上进行汇款操作了。根据反馈,同样是“工行转工行”,手机APP比去柜台一次性成功率高得多,但仍受个人外汇额度限制。

工行加拿大不提供Void Cheque,但可以提供Account Confirmation。这个Confirmation就可以用来拿去像Simplii Financial这样需要Void Cheque才能关联账户的银行操作了。当然,像Tangerine这样只需两笔小额deposit确认就没有这么麻烦。

到家后我细看了工行加拿大的网银,虽然界面丑了点,但是功能还是挺全面的,其中也能进行link external accounts的操作:在网上先提供信息,之后确认工行加拿大存入的一笔小额deposit,再在30天内寄Void Cheque和Signed Agreement。稍显麻烦。工行加拿大也有手机APP,不过试用了一下,也是一个字丑。

这个Link只要在一头完成,就能进行双向转账了,不需要在Link账户的两边都进行设置。

另外,在工行加拿大开户必须本人亲自到场,不能远程开户。个人认为对于居住地没有工行加拿大Branch的朋友,如果有需要的话,可以在刚好去有Branch的大城市的时候开一个。

据了解,还有一种操作是在中国境内的工行“见证开户”,不过按照官方说法,仍然需要本人亲自去柜台领取Debit Card和密码纸:点击查看详情

首次发布:2019-4-6

最后更新:2020-3-8

本文由原作者投稿,观点不代表Chinese Students at MUN立场,转载请联系原作者。