To be eligible, you must meet the following requirements:

- You did not apply for, nor receive, CERB or EI benefits from Service Canada for the same eligibility period

- You did not quit your job voluntarily

- You reside in Canada

- You are 15 years old or more when you apply

- You earned a minimum of $5,000 (before taxes) income in the last 12 months or in 2019 from one or more of the following sources:

- employment income

- self-employment income

- provincial or federal benefits related to maternity or paternity leave

AND

- You stopped or will stop working due to COVID-19, and:

- You are applying for the first time

For at least 14 days in a row during the 4-week payment period, you do not expect to receive more than $1,000 (before taxes) from employment and self-employment income - You are re-applying for another period

You do not expect your situation to change during this 4-week period and you do not expect to receive more than $1,000 (before taxes) from employment and self-employment incomeOR - You received regular EI benefits for at least 1 week since December 29, 2019

You are no longer eligible for EI benefits

- You are applying for the first time

Eligibility periods

Eligibility periods are fixed in 4-week periods.

If your situation continues, you can re-apply for CERB for multiple 4-week periods, to a maximum of 16 weeks (4 periods).

https://www.canada.ca/en/revenue-agency/services/benefits/apply-for-cerb-with-cra.html

Canada Emergency Student Benefit

(Not applicable to international students!)

For post-secondary students and recent graduates who are ineligible for the Canada Emergency Response Benefit or for Employment Insurance, but who are unable to find full-time employment or are unable to work due to COVID-19, the government proposes to introduce the Canada Emergency Student Benefit (CESB). The CESB would provide $1,250 per month for eligible students from May through August 2020, and $1,750 for students with dependents and those with permanent disabilities.

This new grant would provide income support to post-secondary students who will experience financial hardship over the Summer due to COVID-19. The CESB will be delivered by CRA and more details will be communicated.

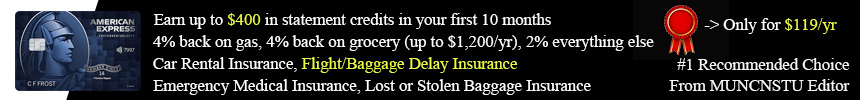

原创文章,作者:MUNCNSTU,未经许可禁止转载。获得转载许可后,请注明出处:https://muncnstu.com/news/canada-emergency-response-benefit-who-can-apply/